Highlights

- Gold and base metal JV’s across the highly prospective Bryah Basin (WA)

- Alchemy retains a 20% interest free carried to production, then 20% share of costs to production repaid from 50% of Alchemy’s share of profit

- Alchemy has re-acquired 100% of the base metal rights to the Sandfire JV ground

- Catalyst Metals (Plutonic Gold Mine owners) are currently ramping up activities in the area and the company is hopeful of advancing Hermes South to production phase near term

- Alchemy also retains a 1% Net Smelter Royalty over 20,000 oz gold beyond 70,000 oz of gold production from Hermes Deposit (production currently ~50,800oz)

- Alchemy has identified significant ore potential on its 100% owned leases:

ASX Announcment 25th Jul 2008 – Assay Results at Three Rivers Gold Project

ASX Announcment 15th May 2009 – Alchemy Enhances Potential for High Grade Iron Formation at Three Rivers

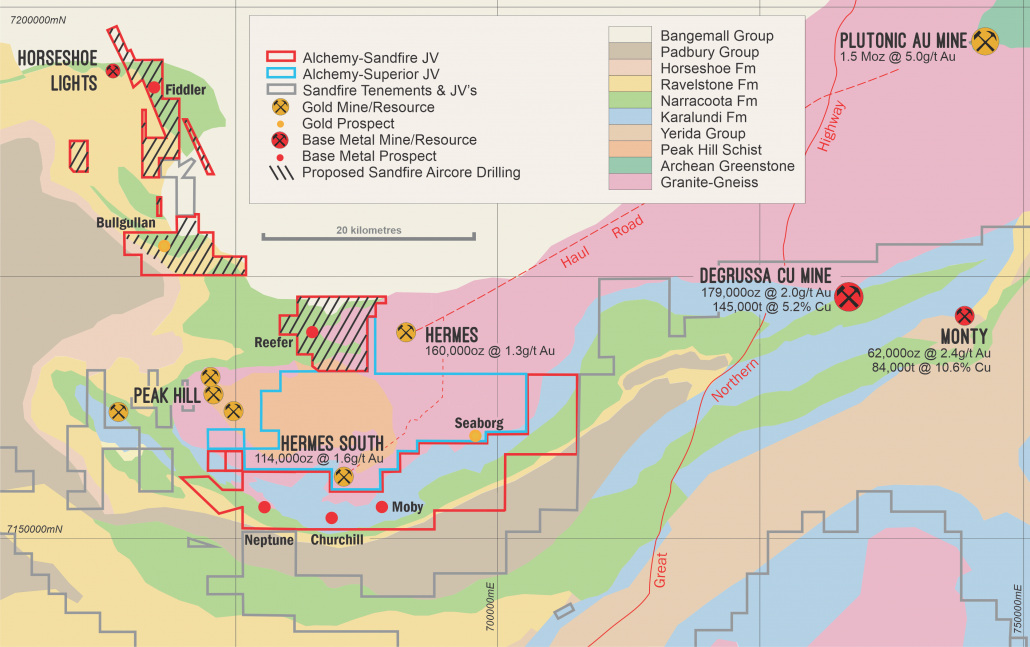

Alchemy’s Bryah Basin Project comprises a 527km2 ground package, located 130km NE of Meekatharra, highly prospective Bryah Basin region, Western Australia. The Project is located along strike and west of Sandfire Resources NL’s (ASX: SFR) high-grade DeGrussa and Monty copper-gold deposits, and adjacent to Peak Hill where about 1Moz of gold has been mined from several deposits (Fig. 1). Alchemy retains a 20% a interest in the base metal and gold prospective Bryah Basin Projects through joint venture agreements with Sandfire Resources NL (ASX: SFR) (“Sandfire”) and Superior Gold Inc. (“Superior”) respectively.

Sandfire are currently drilling aircore holes over Horseshoe Lights, Windalah Bore and Peak Hill North.

The Superior JV contains the Hermes South deposit – JORC 2012 inferred resource of 114Koz @ 1.6g/t Au – mining proposed for Q2 2021.

Alchemy also retains a 1% Net Smelter Royalty over 20,000 oz of gold recovered from the Hermes Deposit once production reaches 70,000 oz (ref. Alchemy ASX announcement dated 24 February 2015). Gold production from Hermes is currently at ~50,800 oz.

Base Metals Exploration (Alchemy 20%)

Leading Australian base metal producer Sandfire Resources NL is actively exploring the base metal prospective areas of the Sandfire Bryah Basin Joint Venture area (red outlines in Figure 1). Sandfire spent approximately $8.9M (including ~$2.9M spent by previous JV partner IGO) to earn a 70-80% interest. Alchemy is now free-carried on further exploration to completion of a Pre-Feasibility Study, and then carried on an interest-free deferred basis for a further $5M of Definitive Feasibility Study expenditure with the deferred amount to be repaid in full from 50% of Alchemy’s share of profits earned through production.

The Sandfire JV area contains more than 60km of strike extent of the Narracoota – Karalundi volcano-sedimentary sequence, host to Sandfire Resources’ DeGrussa copper-gold deposit and the high-grade Monty copper-gold resource (Fig. 1), and prospective for discovery of VMS-style copper-gold deposits. Sandfire has extensive local VMS exploration and discovery experience and is applying its state-of-the-art geophysical tools and renowned in-house geological team to comprehensively evaluate the prospective Narracoota– Karalundi stratigraphy on the JV tenements.

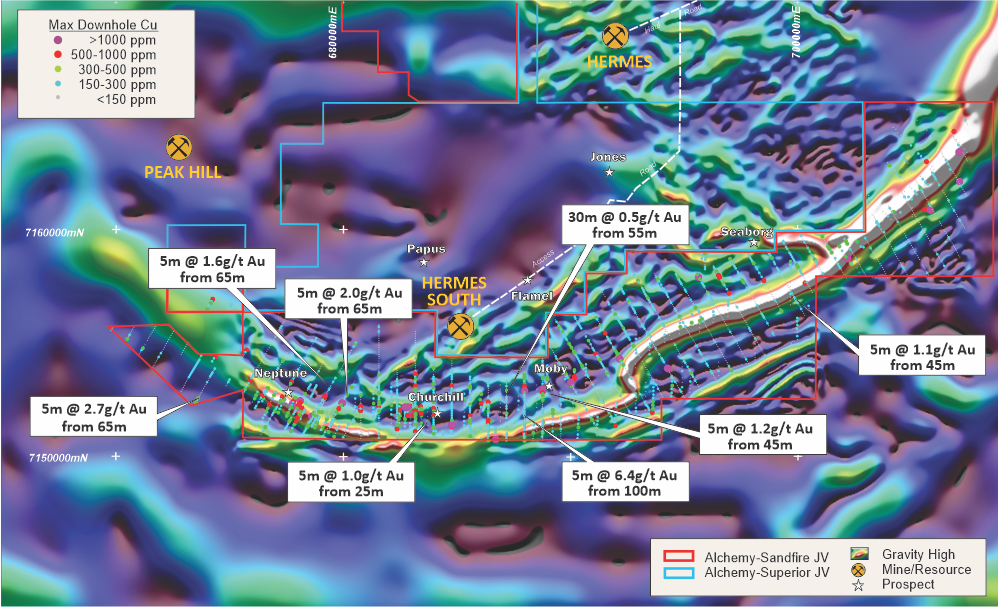

Subsequent to earning their JV interest, Sandfire completed an extensive aircore and follow-up RC program comprised of over 1,700 holes and more than 130,000 of drilling (Figure 2). Significant intercepts to date include:

- 5m @ 6.4g/t Au

- 5m @ 2.7g/t Au

- 5m @ 2.0g/t Au

- 5m @ 1.6g/t Au

Additional aircore drilling within the copper-gold prospective Narracoota Volcanics and Ravelstone Formation sediments (DeGrussa host rocks) to the east of Horseshoe Lights mine is due to commence Q3 2020 at an 800m x 800m drill line spacing. A moving loop electromagnetic (MLEM) survey designed to further improve targeting of the host volcanogenic massive sulphide (VMS) horizon is now complete. Processing of the MLEM data is ongoing and, along with the gravity data, will be incorporated into existing regional datasets and inversion models created. The resulting models will then be used to target VMS mineralisation and further refine Phase 2 drilling.

AC drilling has also been planned for the Horseshoe Lights area. This drilling will target copper-gold mineralisation within the Narracoota volcanics and the Ravelstone Formation sediments.

Gold Exploration (Superior Gold earning up to 80%)

Exploration of Alchemy’s whole and part tenements that cover the gold prospective part of the Bryah Basin Project (Fig. 1) continues under a Joint Venture arrangement with Billabong Gold Pty Ltd a wholly owned subsidiary of Superior Gold Inc. (TSX-V: SGI) (“Superior Gold JV”). Superior has recently earned a 70% interest in Jackson Minerals tenements and an 80% interest in Alchemy tenements.

Alchemy’s interest is carried on an interest-free deferred basis to production, with Alchemy to repay the deferred amount at the rate of 50% of its share of free cash flow from production following commencement of mining.

The Superior Gold JV currently has a JORC Code 2012 compliant inferred resource of 114,000 oz @ 1.6g/t Au) at the Wilgeena Prospect (re-named Hermes South). The mineralisation is open at depth and further drilling has excellent potential to expand the area of gold mineralisation and add to the known resource. Superior plan to commence mining Hermes South during the first half of 2021.

Alchemy also retains a 1% NSR on 20,000oz beyond 70,000oz of gold production from Hermes where production is currently at ~50,800 oz.

Wilgeena / Hermes South Gold Deposit

At Wilgeena (Hermes South), five stacked mineralised zones have been defined by drilling to date. The zones strike approximately east-west, dip to the south at about 45 degrees, and plunge steeply to the east (Fig. 3).

The mineralisation is open at depth at Wilgeena and further drilling has excellent potential to add to the known resource and expand the area of gold mineralisation outside of the Indicated Resource.

Metallurgical test-work undertaken on oxide core material from Wilgeena, obtained from the diamond drilling program in 2010, indicates that the ore is amenable to treatment in a conventional crush, grind and CIL plant with good recoveries across all size fractions. A high proportion of gold is contained in the coarse fraction, and the test-work indicates that a large percentage (40-60%) of the free gold at Wilgeena could be recovered by gravity concentration. No technical issues have been identified that would result in a poor recovery or extenuating cost issues.

Seaborg and Central Bore Gold Prospects

The Seaborg and Central Bore gold prospects, located about 15 kilometres to the north-east of the Wilgeena gold deposit (Fig. 1), are two high priority targets that have returned high-grade gold intercepts in drilling.

Gold mineralisation at Seaborg is in high grade mineralised zones (>5g/t gold) within a broad (20-50 metre thick) lower grade gold mineralised envelope (Fig. 4), associated with a series of northeast-trending veins and structures in meta-sedimentary rocks. The gold mineralisation occurs from surface, and to date has been intersected by drilling to a vertical depth of approximately 75m, within the oxidised zone.

RC and RAB drilling completed to date at the Seaborg Prospect has returned high-grade gold results including:

- 27 metres at 5.43 g/t gold from 15m (historic drill hole)

- 51 metres at 3.71 g/t gold from surface (CBRB001)

- 23 metres at 3.16 g/t gold from 16m (CBRB002)

- 6 metres at 4.17 g/t gold from 9 metres (CBRC062)

Gold mineralisation at the Central Bore gold prospect is associated with a series of northeast-trending veins and structures in granite. Assay results from drilling, including screen fire assays for selected high grade samples, include best intersections of:

- 9 metres at 5.86 g/t gold from 35 metres (CBRC004)

- 9 metres at 3.79 g/t gold from 49 metres (CBRC004)

- 20 metres at 1.99 g/t gold from 32 metres (CBRC005)

- 2 metres at 10.64 g/t gold from 80 metres (CBRC005)

- 4 metres at 5.35 g/t gold from 86 metres (CBRC005)

- 8 metres at 2.48 g/t gold from 61 metres (CBRC011)

- 3 metres at 3.80 g/t gold from 80 metres (CBRC011)

- 15 metres at 1.90 g/t gold from 96 metres (CBRC011)

- 16 metres at 2.48 g/t gold from 86 metres (CBRC018)

- 4 metres at 25.79 g/t gold from 125 metres (CBDD002)

- 14 metres at 3.24 g/t gold from 44 metres (CBRC035)

- 13 metres at 1.41 g/t gold from 80 metres (CBRC035)

- 3 metres at 9.12 g/t gold from 123 metres (CBRC038)

- 9 metres at 4.80 g/t gold from 140 metres (CBRC045)

The recent and previous drilling at Central Bore indicates that the high-grade gold mineralisation may form parallel shoots that plunge to the south-east.

Based on drilling results to date, gold mineralisation at the Seaborg and Central Bore gold prospects remain open at depth and along strike. Further targeted RC and diamond drilling has the potential to expand the areas of gold mineralisation outside of the known mineralised areas.

Competent Persons Statement

The information in this report that relates to Exploration Results is based on information compiled by Mr Leigh Ryan, who is the Managing Director of Alchemy Resources Limited and holds shares and options in the Company. Mr Ryan is a Member of the Australian Institute of Geoscientists and has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (‘JORC Code 2012’). Mr Ryan consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.

The information in this report that relates to Mineral Resources at the Hermes South Gold Deposit is based on information compiled by Mr Stephen Hyland, a geological consultant working for Superior Gold Inc. Mr Hyland is a Fellow of The Australasian Institute of Mining and Metallurgy, and has sufficient experience of relevance to the styles of mineralisation and the types of deposits under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (‘JORC Code 2012’). Mr Hyland consents to the inclusion in this report of the matters based on his information in the form and context in which it appears.